How Much Do I Need to Retire? Photo credit: © iStock/skynesher It can be boiled down to one simple question: How much do I need to save to retire? By putting away a percentage of your income every month from now until you retire, you can do away with the financial anxieties far too many seniors find themselves facing. But a sound retirement savings plan doesn’t have to be complicated. It is loaded with negative connotations: Expensive investment advisors, large stacks of documents and complex spreadsheets, to name a few. That phrase - sound retirement strategy - is where many of us lose interest. For some, that may turn out to be true, but such success stories are more a result of good luck than a sound retirement strategy. To put it another way: It’s common to assume that if we save in good faith, things will work themselves out. The common assumption is that some savings, in addition to Social Security and a less expensive lifestyle (no more kids in the house, no more commuting costs) will all add up to financial security in our sunset years. For most retirees, there are other sources of retirement income besides savings, Social Security being chief among them. On the other hand, just as it’s unwise to save nothing at all, it’s unrealistic to try and save every penny that isn’t already dedicated to paying bills or buying groceries.

#Financial calculators for retirement how to

Want to know how to retire comfortably? Start saving. If money is scarce, however, financial anxiety could crowd these pleasures out. At its best, retirement is a time when the stresses of years one through 65 (or so) fade, leaving room for relaxation, delectation and grandchildren. Needless to say, the save-nothing approach is not recommended.

#Financial calculators for retirement free

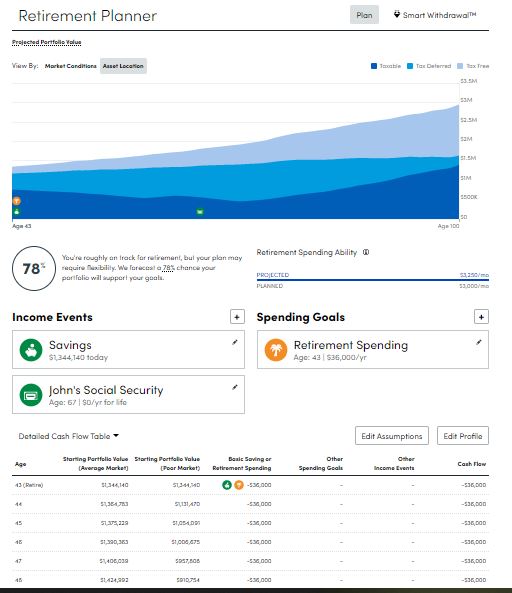

Indeed, surveys have repeatedly shown that the average American retirement savings is too low and that significant numbers of Americans in their 30s, 40s and even 50s have no retirement savings at all.ĭo you need help planning for your retirement? Find a financial advisor who serves your area with our free online matching tool. Amid this daily grind, it’s easy to put retirement savings on the back burner, especially when it’s 15, 20 or 30 years off. There are, after all, more immediate concerns: Job, kids, mortgage payments and car payments, among other costs. We may fantasize about international adventures or beachside escapes, but rarely do we lay the groundwork for realizing our retirement dreams financially. Retirement Calculator Photo credit: © iStock/stevecoleimagesįor a working person, the golden years of retirement can be both easy and difficult to imagine. Return on savings: We assume the return on savings is the same percentage across different savings instruments. Our estimate is sensitive to penalties for early retirement and credits for delaying claiming Social Security benefits. Social Security: We estimate your Social Security income, using your stated annual income and assuming you have worked and paid Social Security taxes for 35 years prior to retirement. To better align with filing season, tax calculations are based on the tax filing calendar, therefore calculations prior to April are based on the previous years tax rules. The tax implications of different tax-advantaged retirement accounts, Social Security income and other sources of retirement income are all considered in our models. Taxes: We calculate taxes on a federal, state and local level. We assume that the contribution limits for your retirement accounts increase with inflation. Retirement accounts: We automatically distribute your savings optimally among different retirement accounts. We stop the analysis there, regardless of your spouse's age.

0 kommentar(er)

0 kommentar(er)